Which of the Following Best Describes Pure Life Annuity

What best describes a pure life annuity settlement option pay outs. Which of the following best represents what is meant by life insurance creates an immediate estate.

Which Of The Following Best Describes Guaranteed Renewable Term Life Insurance At Best

A universal life insurance policy is best described as.

. Which of the following best describes the difference between pure life and life with guaranteed minimum settlement. This differs from a pure life annuity where you receive payments for life regardless of how long you live. Which of the following best describes the difference between pure life and life with guaranteed minimum settlement.

The deceaseds estate or. To purchase insurance the policy owner must face the possibility of losing money or something of value in the event of loss what is this concept called. A life annuity with period certain is a type of life annuity that allows you to choose when and how long to receive payments.

B The policy generates immediate cash value. B Pure life provides payments for as long as both the annuitant and the spouse are living. The surrender value will not be more than 80 of the cash value in the annuity at the time of surrender.

Get quick answers to your annuity questions. A The annuity is subject to state taxes only. The interest accumulated in an annuity is the tax base but the taxes.

Pure or straight life annuity settlement option will only pay for as long as the annuitant lives. This is true for sure. Convertible term life insurance is a policy that provides the insurer with the option of converting a term policy to a permanent one at the conclusion of the term without any penalties or having to undergo a medical.

Eventually upon maturity you are allowed to withdraw money receive annuity benefits from the account. Joint and survivor annuity. Which of the following best describes a pure life annuity settlement option.

Pure life is not in life contingency option. Asked Sep 24 2015 in Business by MangaLover. Life insurance can provide which of the following.

B a series of unequal cash payments made at equal time intervals. C Growth is subject to immediate taxation D Taxes are deferred. Pure life provides payments for as long as the annuitant is alive.

If a contract provides a set amount of income for two or more persons with the income stopping upon the first death of the insured it is called a. It provides the highest monthly benefit. And life with guaranteed minimum payments can be made in installments.

Which of the following best describes a pure life annuity settlement option. Under a pure life annuity an income is payable by the company-Only for the life of an annuitant. However if heshe dies after receiving the first payment no more payments would be made to any other person.

Which of the following best describes the nonforfeiture value of the annuity. Which of the following best describes what the annuity period is. Pure Life Annuity A pure life or lifetime annuity pays a benefit to the annuitant until death.

Which of the following best describes pure life annuity. A pure endowment is a type of life insurance policy in which an insurance company agrees to pay the insured a certain amount of money if the insured is still alive at the end of a specific time period. Pure risk and speculative risk.

Applied for a life insurance policy the agent informed him that a medical exam was required. A Benefits are paid for a fixed period of time specified when the policy begins to pay. C The death benefit will always be paid to the estate of the insured.

Which component must increase in the increasing term insurance. The form of life annuity which pays benefits throughout the lifetime of the annuitant and also guarantees payment for a minimum number of years is called. B The period of time spanning from the accumulation period to the annuitization period c The period of time during which money is accumulated in an annuity d The period of.

If you die before the period is fulfilled the payments will continue to your beneficiary for the remaining time. These payments are usually made as a lump sum. Period Certain vs.

Life with guaranteed minimum will pay the remaining principal to the beneficiary. Under a pure life annuity an income is payable by the company. Which of the following most accurately describes an annuity.

Pure life provides payments for as long as the annuitant is alive. C a stream of equal cash payments made at equal time intervals. Which of the following best describes pure life annuity.

All of the following are true of an annuity owner EXCEPT The owner must be the party to receive benefits. A The policy has cash values and nonforfeiture values. Pure life provides payments for as long as the annuitant is alive When J.

B The annuity is subject to both state and federal taxation. Which of the following best describes a pure life annuity settlement option. Which of the following best describes what the annuity period is.

C Pure life provides payments for as long as the annuitant is alive. A variable whole life policy does not guarantee the. Of course you also pay commission or services charges to the insurance company just like you pay a mutual fund manager commission for maintaining your account.

A an investment which produces increasing cash flows over time. A The period of time during which accumulated money is converted into income payments. An annually renewable policy with a cash value account.

Renewable term life insurance guarantees the policy can be renewed to a predetermined date or. The surrender value should be equal to. Call 800-872-6684 9-5 EST.

Which of the following best describes the difference between pure life and the life of a guaranteed minimum settlement option. This feature is also called a conversion privilege guaranteed renewable or guaranteed. It provides the highest monthly benefits Because of the imposed blackout period the surviving spouse.

Which Of The Following Best Describes Guaranteed Renewable Term Life Insurance At Best

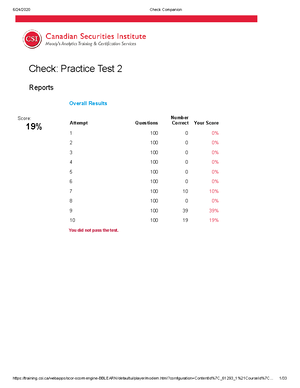

Practice Test 2 Test 2 Biol 203 Fundamental Nutrition Studocu

Which Of The Following Best Describes Term Life Insurance 5 Myths You Should Be Aware Of Let Us Talk Finance

Comments

Post a Comment